Apple (AAPL)

273.68

-0.94 (-0.34%)

NASDAQ · Last Trade: Feb 10th, 9:02 PM EST

Detailed Quote

| Previous Close | 274.62 |

|---|---|

| Open | 274.88 |

| Bid | 274.21 |

| Ask | 274.61 |

| Day's Range | 272.94 - 275.37 |

| 52 Week Range | 169.21 - 288.62 |

| Volume | 34,386,625 |

| Market Cap | 4.52T |

| PE Ratio (TTM) | 34.64 |

| EPS (TTM) | 7.9 |

| Dividend & Yield | 1.040 (0.38%) |

| 1 Month Average Volume | 55,980,325 |

Chart

About Apple (AAPL)

Apple is a leading technology company known for designing, manufacturing, and marketing a range of innovative consumer electronics, software, and services. Its flagship products include the iPhone, iPad, and Mac computers, which are widely recognized for their cutting-edge technology and user-friendly interfaces. In addition to hardware, Apple offers a suite of software applications, operating systems, and digital services such as the App Store, iCloud, and Apple Music. The company is also committed to sustainability and privacy, integrating these principles into its products and operations. With a focus on premium quality and seamless integration across its devices, Apple has established a loyal customer base worldwide. Read More

News & Press Releases

The music platform is winning subscribers at an impressive clip.

Via The Motley Fool · February 10, 2026

Taiwan Semiconductor stock is crushing the market.

Via The Motley Fool · February 10, 2026

On February 10, 2026, Meta Platforms (NASDAQ: META) stands at a pivotal moment. Its stock, trading at $670.72, has recently pulled back from a $744 peak in late January, caught between investor enthusiasm for its AI-led financial surge and deep concerns over its unprecedented $135 billion 2026 capital expenditure

Via MarketMinute · February 10, 2026

On Feb. 10, 2026, investors weighed fresh AI capex worries against rising long-term earnings forecasts for this software giant.

Via The Motley Fool · February 10, 2026

These exchange-traded funds invest in some of the best growth stocks in the world.

Via The Motley Fool · February 10, 2026

Low-code automation software company Pegasystems (NASDAQ:PEGA) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 2.7% year on year to $504.3 million. The company’s full-year revenue guidance of $2 billion at the midpoint came in 7.9% above analysts’ estimates. Its non-GAAP profit of $0.76 per share was 3.5% above analysts’ consensus estimates.

Via StockStory · February 10, 2026

After a meme-fueled rally in 2025, is GoPro a buy, sell, or hold in 2026? Let's take a look and find out.

Via Barchart.com · February 10, 2026

Shares of independent financial services firm LPL Financial (NASDAQ:LPLA) fell 9.8% in the afternoon session after fears of industry disruption grew as wealth management startup Altruist introduced AI-enabled tax planning features, sparking a selloff in U.S. brokerage stocks.

Via StockStory · February 10, 2026

Shares of healthcare diagnostics company Quest Diagnostics (NYSE:DGX)

jumped 6.8% in the afternoon session after the company reported strong fourth-quarter financial results and offered an upbeat forecast for 2026. For the fourth quarter, Quest's revenue grew 7.1% year-on-year to $2.81 billion, surpassing analyst estimates. Its adjusted earnings of $2.42 per share also came in ahead of expectations. Looking forward, the company's full-year 2026 revenue guidance was a notable highlight, coming in 3.3% above consensus estimates. The earnings guidance for the upcoming year also topped forecasts, signaling management's confidence in sustained performance.

Via StockStory · February 10, 2026

The chip foundry just delivered the clearest evidence yet that the unprecedented demand for AI continues to gain steam.

Via The Motley Fool · February 10, 2026

MercadoLibre operates a leading digital commerce and payments ecosystem across Latin America, serving millions of merchants and consumers.

Via The Motley Fool · February 10, 2026

Shares of biopharmaceutical company Incyte Corporation (NASDAQ:INCY)

fell 8.8% in the morning session after the company reported mixed fourth-quarter 2025 results, where a significant revenue beat was overshadowed by an earnings miss. The company's adjusted earnings per share (EPS) came in at $1.80, falling short of Wall Street's consensus estimate of $1.92. This earnings shortfall appeared to be the primary concern for investors, despite revenue showing strong performance. Sales for the quarter grew 27.8% year-over-year to $1.51 billion, comfortably surpassing analysts' expectations. Adding to the pressure, the company's operating margin contracted to 22.3% from 25.6% in the same period last year, indicating that expenses grew faster than revenue.

Via StockStory · February 10, 2026

Shares of health insurance company Oscar Health (NYSE:OSCR) jumped 4.8% in the morning session after the company provided an optimistic financial outlook for 2026 that overshadowed its fourth-quarter 2025 earnings miss. The health insurer reported a fourth-quarter loss of $1.24 per share, which was wider than analyst estimates, while revenue of $2.81 billion also fell short of expectations. However, investors looked past the mixed results and focused on the company's ambitious forecast. For the full year 2026, Oscar Health projected revenue of $18.85 billion at the midpoint, significantly higher than the analyst consensus of approximately $12.76 billion, signaling healthy demand for its products and services.

Via StockStory · February 10, 2026

Shares of global hospitality company Marriott (NASDAQ:MAR)

jumped 9.1% in the morning session after the company reported fourth-quarter 2025 results that showed a strong outlook for 2026, even though its earnings slightly missed analyst expectations.

Via StockStory · February 10, 2026

HONG KONG, Feb. 10, 2026 (SEND2PRESS NEWSWIRE) -- "My iPhone 17 has been locked to prior owner and I can't use it." If you bought a second-hand iPhone 17, or you factory reset the device but forgot the password and email, the iPhone locked to owner screen will appear. What to do when you can't reach to the previous owner or Apple support can't turn off the activation lock? Thankfully, it can be unlocked with iToolab UnlockGo iOS V6.3.1.

Via Send2Press · February 10, 2026

The financial world stood still on February 10, 2026, as the S&P 500 Index (INDEXSP: .INX) surged toward the historic 7,000 psychological barrier. After a relentless multi-year rally driven by the industrialization of artificial intelligence and a resilient "soft landing" for the U.S. economy, the index is

Via MarketMinute · February 10, 2026

The benchmark 10-year U.S. Treasury yield plummeted to 4.14% on Tuesday, February 10, 2026, as investors aggressively repositioned for a more dovish Federal Reserve following a starkly disappointing retail sales report. The move represents a significant departure from the 4.30% levels seen earlier this year, signaling that

Via MarketMinute · February 10, 2026

In a definitive display of pricing power and operational discipline, Spotify Technology S.A. (NYSE: SPOT) reported a blowout fourth-quarter 2025 earnings result on February 10, 2026. The Swedish audio giant surpassed nearly every major Wall Street metric, posting a record operating income of €701 million and a net income

Via MarketMinute · February 10, 2026

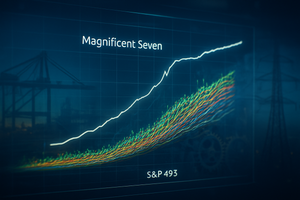

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Date: February 10, 2026 Introduction Corning Incorporated (NYSE: GLW) has long been perceived by the market as a venerable but cyclical manufacturer of glass and ceramics. However, as of early 2026, that narrative has shifted dramatically. Once known primarily for kitchenware and television glass, Corning has successfully repositioned itself as an indispensable "picks and shovels" [...]

Via Finterra · February 10, 2026

As of February 10, 2026, Spotify Technology S.A. (NYSE: SPOT) stands at a critical crossroads. Once viewed as a high-growth but profit-challenged disruptor from Stockholm, the company has successfully transitioned into a mature, cash-flow-generating "audio technology platform." However, this maturity has come with its own set of challenges. While 2024 and 2025 saw the company [...]

Via Finterra · February 10, 2026

Date: February 10, 2026 Introduction In the high-stakes world of mobile advertising and software infrastructure, few companies have undergone a transformation as dramatic or as lucrative as AppLovin Corporation (NASDAQ: APP). Once known primarily as a mobile game developer, AppLovin has evolved into a dominant, high-margin AI powerhouse. As of early 2026, the company stands [...]

Via Finterra · February 10, 2026

As of February 10, 2026, the technology sector continues to grapple with the complexities of AI integration and infrastructure scaling. Amidst this backdrop, Ubiquiti Inc. (NYSE: UI) has emerged as one of the most polarizing and high-performing stories in the enterprise hardware space. Long known as a disruptor of the traditional networking establishment, Ubiquiti has [...]

Via Finterra · February 10, 2026

Financial intelligence company S&P Global (NYSE:SPGI) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 9% year on year to $3.92 billion. Its non-GAAP profit of $4.30 per share was 0.8% below analysts’ consensus estimates.

Via StockStory · February 10, 2026

Financial technology provider Fiserv (NASDAQ:FISV) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.8% year on year to $5.28 billion. Its non-GAAP profit of $1.99 per share was 4.6% above analysts’ consensus estimates.

Via StockStory · February 10, 2026