Over the past six months, United Airlines’s shares (currently trading at $83.60) have posted a disappointing 13.4% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is now the time to buy United Airlines, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think United Airlines Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than UAL and a stock we'd rather own.

1. Weak Growth in Revenue Passenger Miles Points to Soft Demand

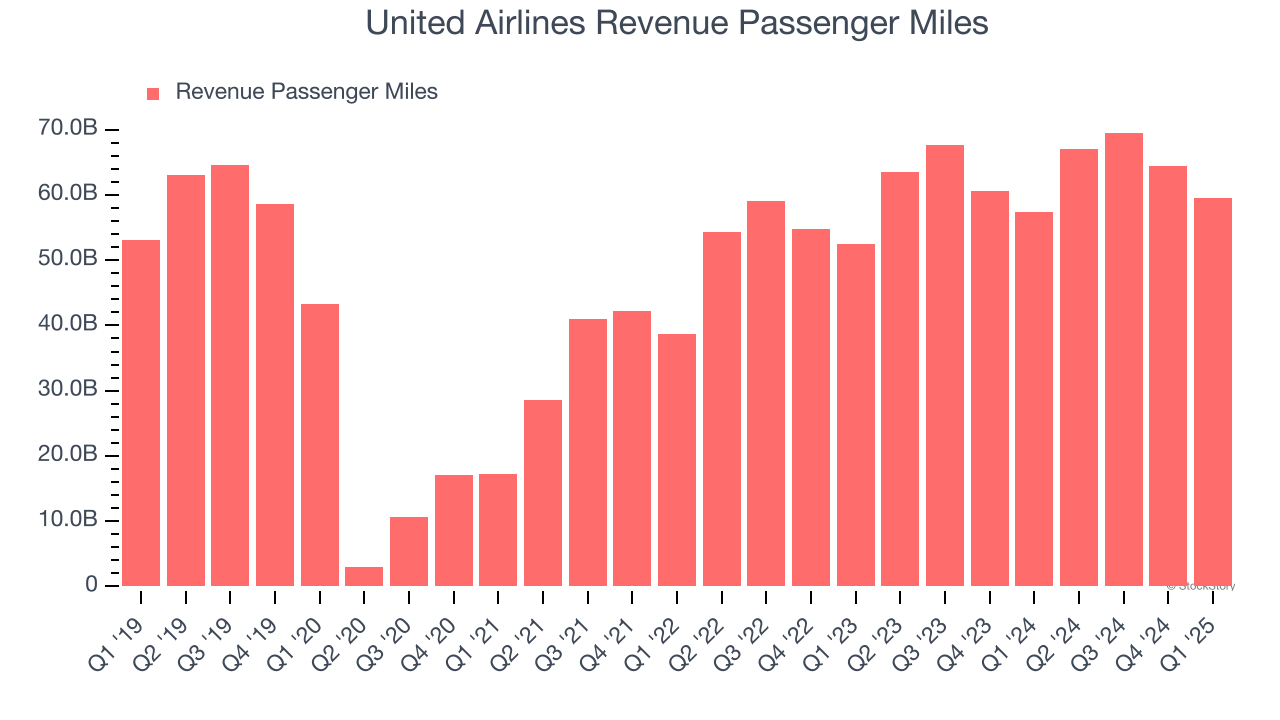

Revenue growth can be broken down into changes in price and volume (for companies like United Airlines, our preferred volume metric is revenue passenger miles). While both are important, the latter is the most critical to analyze because prices have a ceiling.

United Airlines’s revenue passenger miles came in at 59.52 billion in the latest quarter, and over the last two years, averaged 8.7% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict United Airlines’s cash conversion will fall to break even. Their consensus estimates imply its free cash flow margin of 8.4% for the last 12 months will decrease by 6.8 percentage points.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

United Airlines historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of United Airlines, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 7.9× forward P/E (or $83.60 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.